Visit msnbc.com for breaking news, world news, and news about the economy

Randolph Capital Trading Management is a web site designed with traders in mind. Here, you will find charts, commentary, video's and general idea's related to the market on whole. This site is also a record of 'some' of my trades (not all) and any interesting charts that I may come across. Enjoy.

Tuesday, December 14, 2010

Sunday, December 5, 2010

Sunday, November 28, 2010

Euro

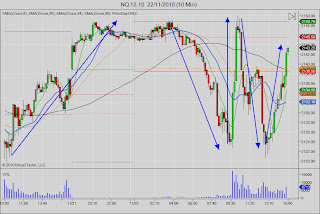

Monday, November 22, 2010

Friday, November 19, 2010

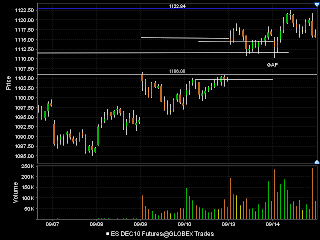

Adding ES long at 1088

Thursday, November 18, 2010

ES

Wednesday, November 17, 2010

Gold chart.

This one is for Jason.

The support area from the QE2 announcement day was clearly at 1328. So, we use that as a place to buy. You go in with 30% of your total size and see if it holds. Yesterday, when we went into the spot, the price was only there for a quick second. That is the second indicator that tells us we had a good entry. Also, we've come off almost 100 points from the high which is still a good size move to consider before going in for a trade. ie what percentage of the contract does that encompass - 8% or so, so it's a decent retracement. Lastly, the 100min chart shows we are still wedging higher and making higher lows...

The 3 min chart shows that we are holding the spot and wedging higher. So, I'm long my next 30%. Once we start to head higher, you finish the entry with your last 40%. I bought 1329/8 and 1335 as the lows are gettting higher. I"ll buy again if we break out past 1344, come back and HOLD. Then your trend should be in... Out target needs to be around 3:1 of our entry price vs our risk. That puts is in around 30 points or somewhere in the 1360's. The stepping process of entering trades works on 1min charts for intraday scalps and on the 60 min charts for swing trades. I don't take position trades as I don't trade on fundamentals.

-

*EDIT* got hit last night on GOLD - 1364/5 - + 31 points.

Tuesday, November 16, 2010

Long ES

Monday, November 8, 2010

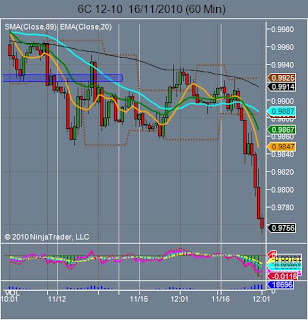

Short CAD

.jpg)

0.9986... sometime overnight

*EDIT* I haven't posted in a bit but I have been in and out of this currency several times this week. The game plan was always the same - sell upper 90's and buy lower 90's. At no time did I ever go long, but I think we may push through par the next go around. Gold and oil have both found support and may continue to push higher. I will sell CAD hard if Gold doesn't hold the 1355's. As a matter of fact, if the CAD cannot get back up to par and Gold continues higher, it could be an indicator that Gold (and silver) are done.

*EDIT* short CAD and Gold on the breakdown this morning through 1355.

Friday, November 5, 2010

Wednesday, November 3, 2010

Gold & CAD

.jpg)

.jpg)

From the way gold is trading I have to think that we are closer to a top than a bottom. The Gap fill was completed and the market reacted by selling off quite significantly. Basically, you're 50 points risk to the upside and 100 plus to the downside... I like the R:R here on the short side. The other possibility is that this becomes one gigantic wedge break to the upside.... lol.

-

Same with the CAD. I will attempt a short in the next 24 to 48 hours up into resistance on both commodities.

-

*EDIT* short starters in Gold and CAD - 1357 and 0,9920 resp.

-

*EDIT* This is why you never go all in at one spot. Took a small loss on my GC contracts and my CAD futures positions. No bid deal. At least we now know what we're playing with. It's interesting that this is all taking place before the open... Could see a massive fade.

Thursday, October 28, 2010

Tuesday, October 26, 2010

Adding 1182

.jpg)

*edit* added again today in the upper 1180's. Full position at 1180 average price. Now that we are fully short, a close above 1190 will take me out.

Added more USD futures long today 77.36 - got the low tick!!

Looking to short the Euro into 1.36 but I can't get a good entry....

*EDIT* I'm out today 1180. +2

No Positions at the moment....

Wednesday, October 20, 2010

Wednesday, October 13, 2010

Tuesday, October 12, 2010

Monday, October 4, 2010

Sunday, October 3, 2010

Tuesday, September 28, 2010

Short NQ 2006

Sunday, September 26, 2010

Monday, September 20, 2010

Added 1126

Tuesday, September 14, 2010

Sunday, September 12, 2010

Thursday, August 26, 2010

My thinking

.jpg)

Looks like we are trading in a range lately. It seems uncertainty does indeed have a range... and 1130 to 1040 looks to be it.

If we go back to July 7 - a day in which the buying was extremely aggressive and a day in which we broke the downtrend of the prior couple of weeks - 1036 is very strong intraday support. I also see 1052 as intraday support too. Just not as strong. Also, 1052 was a good support level for the weeks following - see highlights - and it was the 50% retracement from 1002 to the 1128 high. So, there are a couple of reasons that put the probability in your favour for a long there. I was confident for a long there but took half out on a 5 point breakdown.

Tuesday, August 24, 2010

Wednesday, August 11, 2010

Monday, August 2, 2010

Added into the close on Friday

Thursday, July 29, 2010

Full Fill Long

Filled today - Currently sitting long with a full position in the mid/low 1080's.

*edit* Took out some of today's entry at 1103 for +14 on the entry. Still long with an average down in the 1080's (Sept.) and a couple of Dec. 1055's.

*edit* Took out some of today's entry at 1103 for +14 on the entry. Still long with an average down in the 1080's (Sept.) and a couple of Dec. 1055's.

Currently....

Long a couple of Sept. 1071 (small) and Dec. 1055 (also a couple). Currently bidding 1085 to 1089 for a 3rd and possible final pullback before we head to 1170+. Stops are through 1072.

Monday, July 26, 2010

Offering 1112

Thursday, July 22, 2010

Took some off at 1078

Wednesday, July 21, 2010

Covered the other half

Path of least resistance...

Friday, July 16, 2010

Covering half for +32

Covered the other half @1091 +73 points.

Thursday, July 15, 2010

Subscribe to:

Comments (Atom)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)